Individual and business solutions made simple

The Advanced Markets team at North American is here to help with your business and high net worth individual life insurance cases. Whether a multi-person buy-sell agreement, a policy designed to retain a key executive, or one piece of a larger estate plan, you can turn to our team for marketing materials, case design, and more.

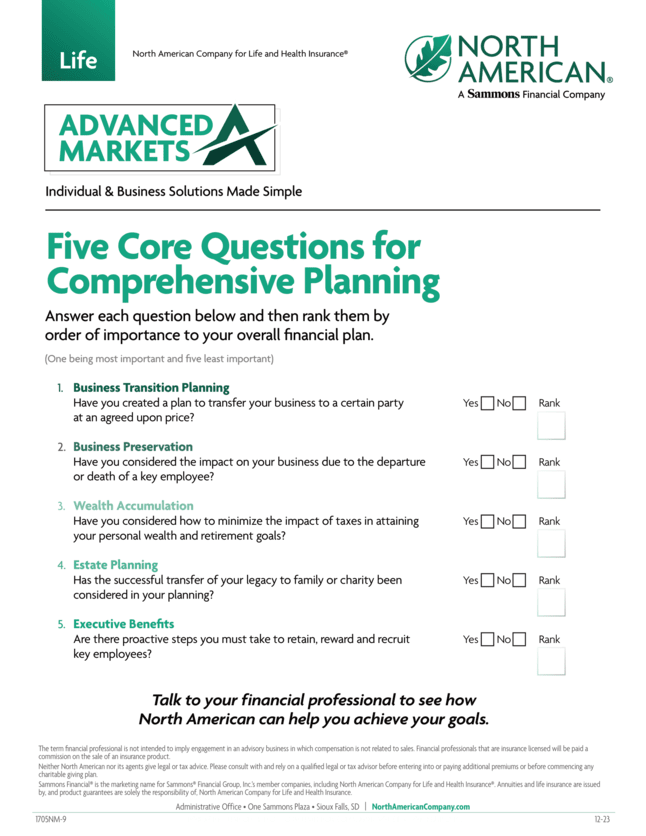

Five Core Needs

North American offers comprehensive solutions for a variety of needs. To help review a client’s needs and prioritize areas of concern, download the Five Core Needs worksheet to walk through each area.

Download flyerSales Concepts

View marketing brochures, materials, forms, and more for each type of case design.

Business Transition Planning

Business Preservation

Estate Planning

- Irrevocable Life Insurance Trust (ILIT)

- Spousal Lifetime Access Trust (SLAT)

- Estate Equalization

- Charitable Planning

Executive Benefits

Wealth Accumulation

- Supplemental Income

- Tax Planning

Resources

View additional resources available to you through North American.

Meet Our Team

With over 70 years of combined industry experience, the North American Advanced Markets team offers a unique combination of expertise and the ability to simplify even the most complex life insurance concepts. Andrew, Tom and Dianna work hand-in-hand with our regional teams to provide expertise and collaboration on complex cases. Have a question for the team? Send them a note at advcasedesign@sfgmembers.com.

Andrew Rinn

JD, CFP®, CLU, ChFC, AVP, Advanced Markets

Tom Martin

Senior Life Product & Competition Analyst

Dianna Holm

Advanced Markets Case Design Consultant

Additional Resources

Advanced Underwriting Consultants is available to answer questions on tax and estate planning scenarios and provide sample documents for no cost to you—it's all part of your valuable North American contract. Reach out to Advanced Underwriting using the below contact information.

Thought Leadership

Discover expert insights and innovative perspectives with Andrew Rinn and the Advanced Markets team through our articles and blog posts.

Split dollar helps attract and keep high-value employees

Executive retention is now at an inflection point as businesses seek to reward and recruit highly valuable employees.

Advanced Markets of Tomorrow

Evolving business models, regulation and consumer demands are transforming the financial planning landscape

Irrevocable Life Insurance Trust (ILIT) and Spousal Lifetime Access Trust (SLAT) should be drafted only by an attorney familiar with such matters. North American nor its agents give tax advice.

Neither North American, nor any of its agents, employees or representatives are authorized to give tax or legal advice. Advise customers to contact their own independent qualified tax or legal advisor before commencing any charitable giving plan.

The terms and conditions of the REBA are not part of the policy issued by North American Company for Life and Health Insurance® and as such North American is unable to enforce directly any restrictions on the policy that are part of the REBA agreement.

Under an endorsement split dollar arrangement, your client enters into an agreement with their employer. North American is not a party to this agreement and North American's only obligation is to administer the policy it issues consistent with the policy's terms and conditions.

Under an endorsement split dollar arrangement, the value of the life insurance afforded the employee is taxable to the employee. The employer should provide the employee with tax reporting based on requirements specified in the tax code. The parties to the endorsement split dollar arrangement should seek their own independent legal and tax advice as to whether and how to enter into an endorsement split dollar arrangement based on the employer's and employee's unique circumstances.

Under a split dollar agreement, classified as a welfare benefit plan, the employee must belong to a select group of management, which includes quantitative and qualitative elements. To meet the quantitative standard, plans should be limited to the top 15% of the workforce. To meet the qualitative test, a significant disparity should exist between the average compensation of the top-hat group and the average compensation of all other employees.

Under a loan split-dollar agreement, the employee enters into an agreement with the employer. North American Company for Life and Health Insurance® is not a party to this agreement and North American's only obligation is to administer the policy it issues. (consistent with the policy's terms and conditions).

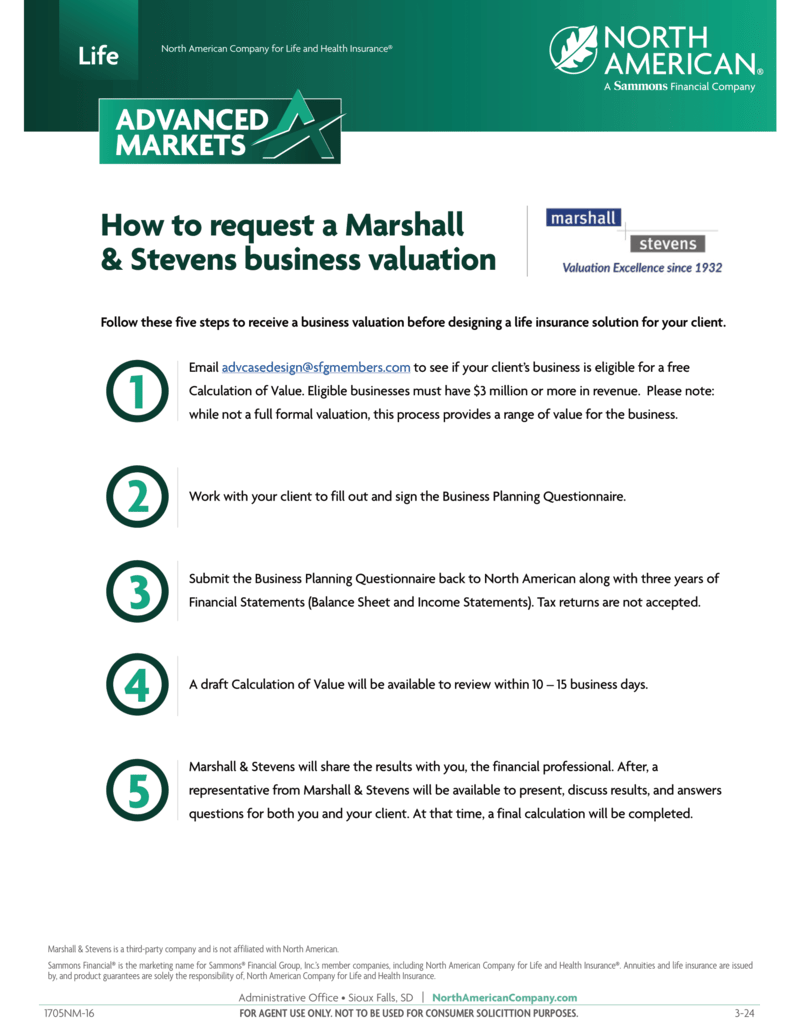

Marshall & Stevens is a third-party company and is not affiliated with North American.

1670NL-24

FOR AGENT USE ONLY. NOT TO BE USED FOR CONSUMER SOLICITATION PURPOSES.

4-24