Can a fixed index annuity help protect against sequence of returns?

Jun 6, 2024, 6:43:32 PM | Reading Time: 5 minutesPeople typically think of the average rate of returns when it comes to investing or sustaining their retirement income. However, what might be more impactful is not the average return but the order of returns and how this could potentially impact retirement savings.

What is sequence of return risk?

Sequence of return risk, or sequence risk, occurs when retirees face negative market returns shortly before or right after retirement. Suppose a market downturn occurs during this time period. In that case, it can potentially significantly impact retirement savings and an overall financial portfolio since there is less time to recover from those losses.

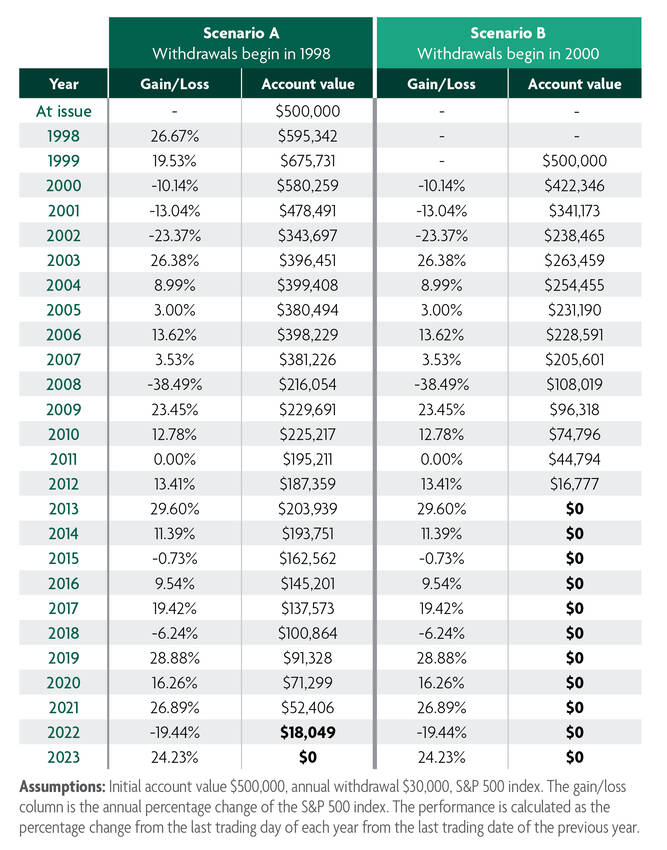

Let’s compare two hypothetical situations. In both scenarios, $500,000 is saved for retirement. In the two hypothetical examples, scenario A begins withdrawing in 1998, and scenario B begins taking withdrawals just two years later in 2000. You would expect both to have an equal depletion of their assets and run out of money two years apart, but this is not the case because of the sequence of returns. Twenty-one years later, with just a difference of two years from when withdrawals started, scenario A still has over $100,000, while the account in scenario B is depleted by year 15.

A fixed index annuity (FIA) might be an option to help mitigate the risk of potentially outliving retirement savings. FIAs can offer a balance of protection from market downturns and growth potential.

Balancing growth potential and market downturn protection

With so many potential hurdles and uncertainty, some may want to find a retirement income planning product that helps balance the need for stability and provides growth potential. FIAs can offer both. A fixed index annuity has the potential for interest to be credited based in part on the performance of specific indices, without the risk of loss of premium due to market downturns. Some key features of FIAs are:

Annual reset

An annual reset feature locks in interest credits annually, meaning index credits cannot be lost due to market decreases. The “annual” reset feature applies to credit terms that span one year. For terms longer than a year, the reset feature coincides with the length of the term. This feature helps both in growing and in protecting retirement nest eggs; not only will you not lose value from market downturns, but the new starting point for future growth calculations is the lower index value (assuming a market decrease).

Stability over time

Designed to provide reliable lifetime income, fixed index annuities can bring more financial certainty to retirement. When looking at FIA risks compared to other popular retirement planning options, these products fall on the lower end of the risk spectrum, where premiums cannot be lost due to a market downturn. Adding a fixed index annuity can complement many retirement portfolios, including those on the higher side of the risk spectrum, because they offer protection from market downturns and potential for growth. Fixed index annuities are attractive for many looking to add stability to their retirement income plans. Not only can a FIA offer growth potential, but it can also provide a way to turn retirement savings into guaranteed retirement income.

Sammons® Financial Group, Inc.’s member companies, including North American Company for Life and Health Insurance®. Annuities and life insurance are issued by, and product guarantees are solely the responsibility of, North American Company for Life and Health Insurance.

Fixed index annuities are not a direct investment in the stock market. They are long term insurance products with guarantees backed by the issuing company. They provide the potential for interest to be credited based in part on the performance of specific indices, without the risk of loss of premium due to market downturns or fluctuation. Although fixed index annuities guarantee no loss of premium due to market downturns, deductions from the accumulation value for additional optional benefit riders or strategy fees associated with allocations to enhanced crediting methods could exceed interest credited to the accumulation value, resulting in loss of premium. They may not be appropriate for all clients. Interest credits to a fixed index annuity will not mirror the actual performance of the relevant index.

This information is provided for general reference purposes and should not be viewed as investment advice or as a recommendation for a specific allocation. Neither North American, nor any agents acting on its behalf should be viewed as providing legal, tax or investment advice. Always consult with and rely on your own qualified advisor.

The “S&P 500®” and “DJIA®”, Indices (“Indices”) are products of S&P Dow Jones Indices LLC or its affiliates (“SPDJI”) and have been licensed for use by North American Company for Life and Health Insurance® (“the company”). Standard & Poor’s® and S&P® are registered trademarks of Standard & Poor’s Financial Services LLC (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”); and these trademarks have been licensed for use by SPDJI and sublicensed for certain purposes by the company. Products are not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, or their respective affiliates and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability for any errors, omissions, or interruptions of the Indices.

Source for chart: https://www.macrotrends.net/2526/sp-500-historical-annual-returns

B4-NA-6-24