The benefits of fixed index annuities in a bear market

Jun 6, 2023, 7:31:33 PM | Reading Time: 4 minutesHow FIAs help build confidence during a bear market Bull and bear markets are standard terms you may hear when the media discusses the economy, and while they’re both normal parts of the stock market cycle, they look very different. When there is a 20%or more drop in a major stock market index over some time, that is known as a bear market. A bull market is the opposite, where we see at least a 20% rise in stock prices over two months or more.

Bear markets occur approximately every 5.5 years, with an average decline of 34.5%. When the market drops, it’s understandable to feel uneasy, especially if you’ve already entered retirement and are concerned about your savings losing value. The good news is there are financial products that can bring asset protection to your overall portfolio, even during market downturns. One of these solutions, a fixed index annuity (FIA), can provide growth potential and downside protection.

The advantages of a fixed index annuity in a bear market

Including a fixed index annuity in your retirement income plan can help bring stability and security to your financial situation during a bear market. An FIA offers the opportunity for tax-deferred growth while protecting your premium from market volatility.

Low risk

Low risk

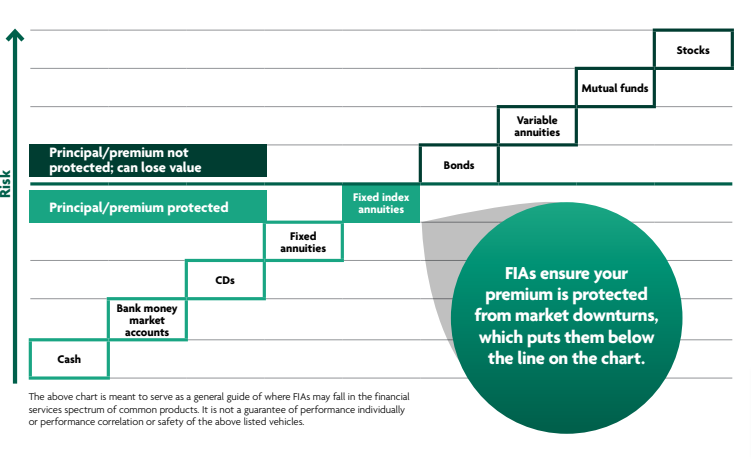

Falling on the lower range of the risk spectrum, fixed index annuities “lock in” interest credits. Any interest credits cannot be lost during market downturns, and your premium is protected from market downturns. Take a look at where FIAs compare with other products in light of risk.

Growth

Adding an FIA to your overall retirement accumulation strategy can help you start or continue building your retirement savings. While some stocks and other investments decline due to market volatility, fixed index annuities can help create a foundation of conservative tax-deferred growth. Even if the market declines, your interest rate will never be less than zero.

Safety

Safety

During a bear market, you may worry your retirement goals will get off track. With an FIA as part of your financial plan, you can protect a portion of your retirement savings when a bear market arises. Since interest credits are linked to market performance and not directly invested in the market, an FIA will not lose value during a market decline. Plus, if you’ve already begun receiving income payments from your annuity, that money is protected and will continue as scheduled, even during a bear market.

Flexibility

Flexibility

Depending on your contract, you may be able to start receiving annuity payments within a year of purchasing an FIA, or you can defer the costs to a later date. Several FIAs also offer an annual penalty-free withdrawal amount, typically a percentage of your accumulation value, that you can take out without a surrender charge. Additional liquidity options can be available, like withdrawing funds to help cover the cost of an extended nursing home stay.

Guaranteed income

Guaranteed income

To help turn your savings into guaranteed income you can count on throughout retirement, many FIAs have built-in or optional income riders. A bear market will not disrupt these payments or cause their value to drop.

Talk to a financial professional during a bear market

It’s not uncommon to feel uneasy during market fluctuations, but it’s important not to panic or make sudden financial decisions. Since ups and downs are a normal part of the cycle, remember that the market will recover. Meeting with a financial professional can offer some reassurance and allow you to review your retirement plan to ensure it matches your goals and risk tolerance. If you’re interested in striking a balance between growth potential and protection for your retirement assets, no matter the market environment, consider exploring the benefits of a fixed index annuity and how it can help bring more financial security to your retirement.

Fixed index annuities are not a direct investment in the stock market. They are long-term insurance products with guarantees backed by the issuing company. They provide the potential for interest to be credited based in part on the performance of specific indices without the risk of loss of premium due to market downturns or fluctuation. Although fixed index annuities guarantee no loss of premium due to market downturns, deductions from your accumulation value for additional optional benefit riders could, under specific scenarios, exceed interest credited to the accumulation value, resulting in a loss of premium. They may only be appropriate for some clients. Interest credits to a fixed index annuity will not mirror the actual performance of the relevant index.

A surrender during the surrender charge period could result in a loss of premium. Surrender charge structure may vary by state.

This information is provided for general reference purposes and should not be viewed as investment advice or a recommendation for a specific allocation. Neither North America nor any agents acting on its behalf should be viewed as providing legal, tax, or investment advice. Clients should always consult with and rely on their qualified advisors.

The term financial professional is not intended to imply engagement in an advisory business in which compensation is not related to sales. Financial professionals that are insurance licensed will be paid a commission.

B4-NA-6-23